this post was submitted on 05 Jan 2024

1053 points (95.9% liked)

memes

10285 readers

2302 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

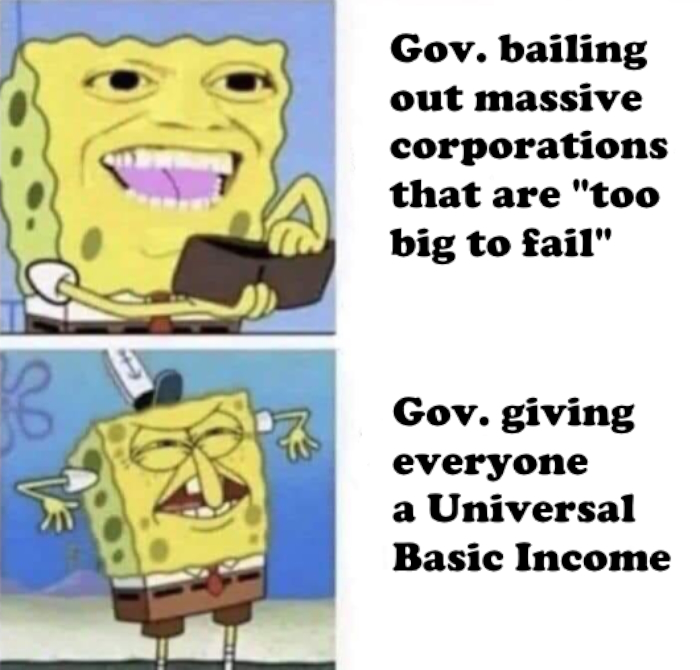

I'm ignorant, and maybe I shouldn't ask this in a meme community, but wouldn't a UBI become the new $0?

Like all the corporations now know we get x-amount more so now prices are adjusted to take a portion of that across all sectors, and now I'm back to not being about to afford the same things as before? Idk I don't have an econ degree.

Not really. It's not magical money that just appears.

It's redistributed money.

Things may increase in price, not because of greed, but because supply and demand jumped dramatically. Think of all the people who now have money to buy random things like treats or toys.

That's not a bad thing! Suddenly, companies need to hire more people to increase supply, because people have resources to spend.

Expensive stuff still exists. No matter what. But the bare minimum quality of life increases dramatically.

No because taxation would be adjusted so the average person is no better off.

It's about raising the lowest earners to a minimum level that they're able to live on, without making them jump through hoops or prove they are poor or prove they have been looking for work for 40 hours a week or some bullshit.

The way I think about it is by creating a scenario. We give 100% of people $1000 dollars (just for sake of argument). Some people use this for groceries, others for car payments, others for investments. Some people don't even realize they got that money bc they were so rich. Some people can afford to pay for school supplies for kids. They key point is not everyone is using it for the same thing.

The reason it sounds like it should become the new zero is bc it does happen in some situations. If the government gave everyone that rents $100, then landlords will raise rent by $100 a month later. The main difference between the two is how specific the scope of the money is.

Yes, there would be economic changes (not necessarily downsides) such as higher inflation due to government spending, but also increased GDP which will stimulate the economy drastically. It will lead to higher unemployment, not bc people stop needing to work, but bc they can quit their second job or focus on taking care of kids full time (which that actually doesn't change unemployment, but it would change the workforce numbers).

I am not an economics major or anything, but I tried to give reasons to explain why we would expect these changes to happen in the real world.

UK gave away a lot of money during the pandemic to support low earners, it backfired real hard.

Governments should invest into education so people can move to more productive jobs which pay more money. That will improve the lives of everyone. There should be no low skilled jobs in developed countries. Giving free money instead is always a bad idea.

Those corporations would still be competing with each other to be the one we spend that $ at though.

I think one of the most common sources of confusion about economics these days is not drawing the line between a market corrupted by some price-fixing cartel, and a free market where actual competition takes place.

Lots of people just assume collusion in all markets. I think that’s a cartoonishly simplistic view of the world, but you gotta remember lots of people assume “capitalism” refers to the thing better called “a price fixing cartel”.

They will, but then there are landlords who can jack up prices for no reason and you'll pay them because you don't want to be homeless. Landlords win, everyone else loses.

Disclosure: I don’t have an econ degree either

I don’t think that mechanism you’re referring to automatically finds its new equilibrium right back where you started.

Let’s take rent for instance. All the current renters in lowest income bracket now have $1000/mo more to spend.

Next income bracket up now has $800 more to spend. Not because the UBI is varying, but because the tax people are paying into the UBI is varying. So this next bracket up is putting $200 into it as taxes and getting their $1000 check. At a certain point, there are the people who break even. And above that, people are paying more into the system than they’re getting back. That’s worth mentioning.

But focusing on this lowest income bracket as if it’s a little segmented, separate economy. Like a slice, to analyze it.

Town with 100 people. Let’s say there’s 105 units of housing, making for a teeny bit of pressure on landlords via competition. The landlords live elsewhere; ultra simple model here. Each of the 100 people gets $1000 more to spend. Fuck it, all they’re spending it on is rent. It’s the only thing they have to buy.

Well, there’s still competition between the landlords. If a landlord’s got an empty unit, he can offer it for $200 less than the other guy and get a tenant in there. Excess supply is good for consumer negotiating power.

But also, let’s say all units just go up by $1000/mo, and swallow up the UBI.

Then other developers now have a new equation in terms of the costs and benefits of building new housing.

Maybe now that you can charge $1500 for an apartment instead of $500, it’s worth it to build a new apartment building. It’s become more profitable.

So someone builds a new apartment building, and there’s 120 housing units for those 100 renters. Now you’ve got 20 desperate landlords (or one landlord with 20 un-rented units) willing to take say $1000 instead of $1500.

That pushes the price of rent back down.

Of course it doesn’t actually sway wildly like this. Every player thinks ahead about all the moves that can be made.

Like if your apartment building is profitable at $1500 but not at $500, what’s the cutoff? Maybe if rents drop below $1200 your new apartment building is going to lose money.

There’s some equilibrium point, and that’s what the market price settles into, as people finding themselves far from that point find it profitable to move toward it. (You make more money renting out five units at $1000 than you make renting out two units at $1500 - lowering the price is profitable here).

So now to crack this model open again, what is this “other place” where these landlords are coming from to invest new money in housing?

That’s where we bring in the higher income tiers, the ones who pay more into UBI than they receive out. The money is coming from up there. In those places, the people have less money than they did before, and so it is becoming less profitable to fulfill their needs. Maybe the amount you can get for a luxury apartment in manhattan drops from $50k to $49k per month.

Ultimately, resources used to fulfill demands, get slowly and steadily re-allocated to serve money’s new center of gravity, which is slightly lower than before.

Prices go up for poor people goods, but not enough to eat all the income. And the new amount of money flowing improves the offering, even at the same price levels, by bringing more investment overall into those industries.