this post was submitted on 25 Mar 2025

457 points (98.3% liked)

Greentext

5837 readers

1322 users here now

This is a place to share greentexts and witness the confounding life of Anon. If you're new to the Greentext community, think of it as a sort of zoo with Anon as the main attraction.

Be warned:

- Anon is often crazy.

- Anon is often depressed.

- Anon frequently shares thoughts that are immature, offensive, or incomprehensible.

If you find yourself getting angry (or god forbid, agreeing) with something Anon has said, you might be doing it wrong.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

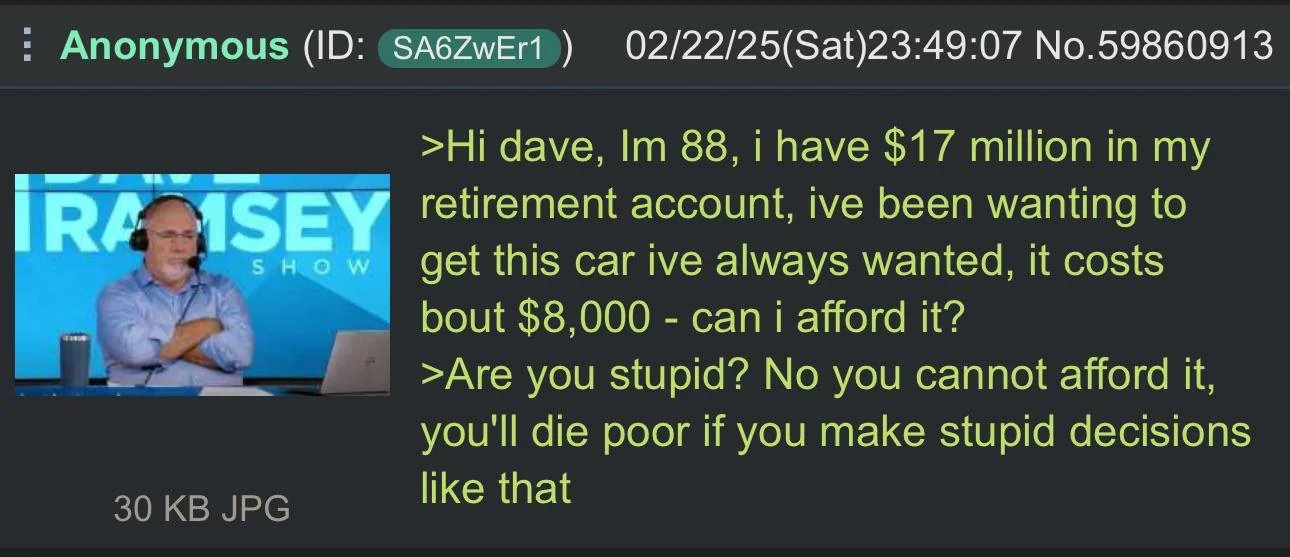

Dave Ramsey's advice is only ever applicable to those who are terrible with self-control. If you have at least mediocre self-control, carefully managed debt can be a boon

There is a British financial advisor who basically says the same thing.

If you can actually manage debt make sure to get some. And then pay it off.

One example: If you get to own a house (that's paid off) not having debt on it is stupid because you get the lowest interest a regular person possibly can get. Even if everyone else has interest rates up to their mouth you'll get a rate so cushy investing the money in any index fund will outperform your interest payments.

Disagree, sure you can make more in the open market over time by getting another mortgage on a paid off home.

But that invested money means absolutely nothing if the market has a downturn and you lose your job. Now you're on the hook to a mortgage you can't pay and risk losing a place to live.

While on paper you can make more money, it's very dumb to gamble with things you need to survive. And that's all any loan is, a gamble that you will be in good health and have the means to pay it back.

That really depends on how risk averse you are, what your payment is, and how stable your job is. For example, my payment is tiny because I got a great rate, bought below my means, and have owned it for several years (so inflation is doing its thing). At this point, I spend more on food than I do on my house.

To mitigate risk, I keep a sizable emergency fund (sustain lifestyle for 6 months), which is currently invested in very safe bonds and money market funds returning a higher rate than my mortgage rate. Why would I pay down my mortgage when I can get more essentially risk free in bonds?

I really like Dave's question: if you had a paid off house, would you get a mortgage on it? My answer is, hell yeah if I could get the same rate I have now! It's free money!

If my rate was >5%, I'd pay it down aggressively. But it's way below that, so I'm holding it until I have enough to retire.

Yeah when he's talking about debt he means small scale stuff like credit card debt. Basically you buy your groceries on your credit card rather than your debit card even though you could buy them on your debit card.

The reasoning being is that that way you get an extra month of interest before you have to pay out, and you get a good credit score since you always pay off your loans. Which weirdly is actually better than having no credit score at all because you've never had any debt.

There is a distinct difference between taking out a loan on your house and saddling it 100% with debt again. Obviously any loan taken out should under all circumstances be one you can comfortably pay back.

Taking out 20k on a 1m home is way different than taking out 20k on a 100k home.

Plus, at least here, if you lose your job the following happens:

Couple that with not being stupid and getting a loan that eats your entire home as backing and you are pretty much safe from any short term disruption in your finances.

To touch on a few other points:

And worst comes to worst, rent out a room in your house as a sublet and use that to pay exclusively for the mortgage. Any loan you ever take out against an owned home shouldn't have higher monthly payments than that anyway or it, as you say, turns into an insane gamble no one in their right mind should take.

And that's the difference. Here you just get to be foreclosed on.

So yeah with having reasonable social safety nets in place the idea is a lot more reasonable