this post was submitted on 24 Nov 2024

1121 points (95.5% liked)

Comic Strips

18215 readers

1955 users here now

Comic Strips is a community for those who love comic stories.

The rules are simple:

- The post can be a single image, an image gallery, or a link to a specific comic hosted on another site (the author's website, for instance).

- The comic must be a complete story.

- If it is an external link, it must be to a specific story, not to the root of the site.

- You may post comics from others or your own.

- If you are posting a comic of your own, a maximum of one per week is allowed (I know, your comics are great, but this rule helps avoid spam).

- The comic can be in any language, but if it's not in English, OP must include an English translation in the post's 'body' field (note: you don't need to select a specific language when posting a comic).

- Politeness.

- Adult content is not allowed. This community aims to be fun for people of all ages.

Web of links

- !linuxmemes@lemmy.world: "I use Arch btw"

- !memes@lemmy.world: memes (you don't say!)

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

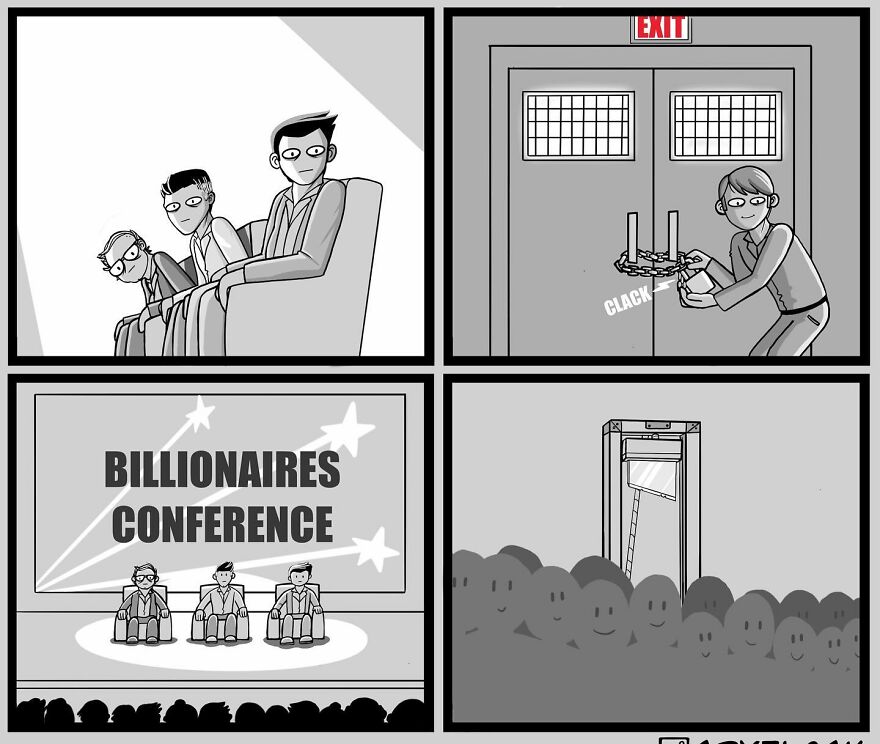

one big issue is everyone goes "you can't tax stocks!" and then billionaires take a loan against the stocks with the unrealized gains as collateral. So we'd need to start classifying a loan as a realized gain of the collateral against this, with an exception for mortgages on primary domiciles, maybe also a "first million dollars are exempt," calculated on the full debt of the borrower, not per loan. I can't imagine anyone taking out more than $1M in debt against a properly they don't live in is not the rich we need to be taxing.

Yeah. Virtually anything with an exception for the first million dollars will both lose almost no tax revenue (as a percentage), and never ever touch the rest of us temporarily embarrassed not-quite-yet-billionaires.

That’s an insightful point, and honestly taxing those loans as realized gains sounds entirely reasonable. It’s good for the lenders because of reduced risk, it’s good for the rich because it keeps them honest, and it’s good for the public because we gain increased tax revenue from those who can most afford it. Nice!