Welcome to baby Marxist rehabilitation camp.

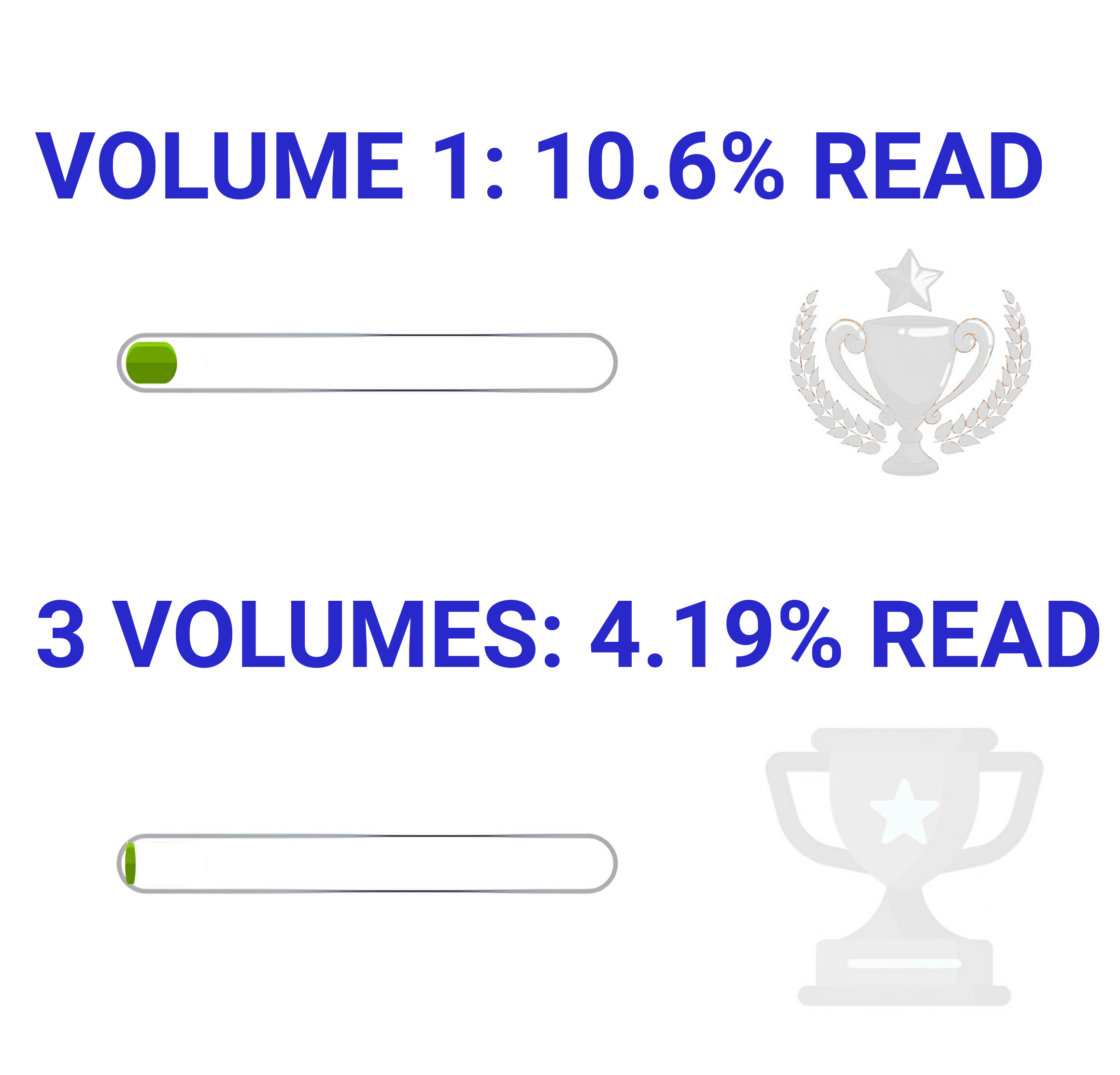

We are reading Volumes 1, 2, and 3 in one year. (Volume IV, often published under the title Theories of Surplus Value, will not be included in this particular reading club, but comrades are encouraged to do other solo and collaborative reading.) This bookclub will repeat yearly until communism is achieved.

The three volumes in a year works out to about 6½ pages a day for a year, 46⅔ pages a week.

I'll post the readings at the start of each week and @mention anybody interested. Let me know if you want to be added or removed.

Congratulations to those who've made it this far. We are almost finished the first three chapters, which are said to be the hardest. So far we have just been feeling it out, now is when we start to find our stride. Remember to be methodical and remember that endurance is key.

Just joining us? It'll take you about 4-5 hours to catch up to where the group is.

Week 3, Jan 5-21, we are reading Volume 1, Chapter 3 Section 3 'Money', PLUS Volume 1, Chapter 4 'The General Formula for Capital', PLUS Volume 1, Chapter 5 'Contradictions in the General Formula'

Discuss the week's reading in the comments.

Use any translation/edition you like. Marxists.org has the Moore and Aveling translation in various file formats including epub and PDF: https://www.marxists.org/archive/marx/works/1867-c1/

Ben Fowkes translation, PDF: http://libgen.is/book/index.php?md5=9C4A100BD61BB2DB9BE26773E4DBC5D

AernaLingus says: I noticed that the linked copy of the Fowkes translation doesn't have bookmarks, so I took the liberty of adding them myself. You can either download my version with the bookmarks added, or if you're a bit paranoid (can't blame ya) and don't mind some light command line work you can use the same simple script that I did with my formatted plaintext bookmarks to take the PDF from libgen and add the bookmarks yourself.

Resources

(These are not expected reading, these are here to help you if you so choose)

-

Harvey's guide to reading it: https://www.davidharvey.org/media/Intro_A_Companion_to_Marxs_Capital.pdf

-

A University of Warwick guide to reading it: https://warwick.ac.uk/fac/arts/english/currentstudents/postgraduate/masters/modules/worldlitworldsystems/hotr.marxs_capital.untilp72.pdf

-

Reading Capital with Comrades: A Liberation School podcast series - https://www.liberationschool.org/reading-capital-with-comrades-podcast/

Chapter 5: Contradictions in the General Formula

Colin Capitalist buys a fish from Frankie Fisherman. Colin Capitalist sells it to Consuela Consumer. Frankie and Consuela are both playing a C-M-C game; they are not capitalists. Only Colin in playing an M-C-M game.

At the beginning of the chapter, Marx looks at a fair barter (C-C) and a fair C-M-C, and says they are similar: no value is gained or lost. They are both fair. C-M-C is just more convenient than barter but is not exploitative.

One reason to do fair C-M-C is that someone who sews all the time gets more sewing done in an hour than I would (coz they're slicker), so I trade an hour of my time (transformed into money) for an our of their sewing-produce.

This is pretty questionable in the 21st century; e.g. Beats By Dre headphones cost $20 to make, sell for $200

Marx is eager to show that the exchange of commodities is not the source of surplus-value/profit.

Marx dismissees the claim that profit comes from selling at (say) 110% of production costs. If everyone overpaid for everything, the producer would overpay for his raw materials, the man who takes his wages to market would have gotten those wages by overcharging: it would all balance out. Everything would be marked up 10% and it would be the same as a fair (equitable) C-M-C.

'The idea of profits being paid by the consumers, is, assuredly, very absurd. Who are the consumers?' (G. Ramsay, An Essay on the Distribution of Wealth)

"The consistent upholders of the mistaken theory that surplus-value has its origin in a nominal rise of prices or in the privilege which the seller has of selling too dear assume therefore that there exists a class of buyers who do not sell, i.e. a class of consumers who do not produce. The existence of such a class is inexplicable"

Profit, in the usual condition of the market, is not made by exchanging. Had it not existed before, neither could it after that transaction' (Ramsay)

There are cases where the seller outsmarts the consumer and charges too much, but these can't explain the origin of profit in the big picture of the economy: the "perplexity may perhaps have arisen from conceiving people merely as personified categories, instead of as individuals."

"However much we twist and tum, the final conclusion remains the same. If equivalents are exchanged, no surplus-value results, and if non-equivalents are exchanged, we still have no surplus-value. Circulation, or the exchange of commodities, creates no value."

Marx considers the profits made by userers and merchants to be a pre-capitalist M-C-M', saying that because circulation can't explain surplus-value.

*"In the course of our investigation, we shall find that both merchants' capital and interest-bearing capital are derivative forms, and at the same time it will become clear why, historically, these two forms appear before the modern primary form of capital." So he's not explaining it yet.

"In usurers' capital the form M-C-M' is reduced to the unmediated extremes M-M'"

Aristotle: "the usurer is most rightly hated, because money itself is the source of his gain, and is not used for the purposes for which it was invented. For it originated for the exchange of commodities, but interest makes out of money, more money."

A producer labouring produces one hour worth of value per hour. So there's no "surplus" there either; he doesn't produce 1.1 value-unit per labour-unit.

The main point of this chapter on 'Contradictions in the General Formula [of Capital]' is: "the formation of capital must be possible even though the price and the value of a commodity be the same, for it cannot be explained by referring to any divergence between price and value"

This quote gives some insight into the labour theory of value and the difference between price and value: "How can we account for the origin of capital on the assumption that prices are regulated by the average price, i.e. ultimately by the value of the commodities? I say 'ultimately' because average prices do not directly coincide with the values of commodities, as Adam Smith, Ricardo, and others believe."

Marx ends the chapter with a problem to be solved: "The money-owner, who is as yet only a capitalist in larval form, must buy his commodities at their value, sell them at their value, and yet at the end of the process withdraw more value from circulation than he threw into it at the beginning. His emergence as a butterfly must, and yet must not, take place in the sphere of circulation. These are the conditions of the problem."