this post was submitted on 18 Apr 2024

783 points (98.5% liked)

Political Memes

5441 readers

3118 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

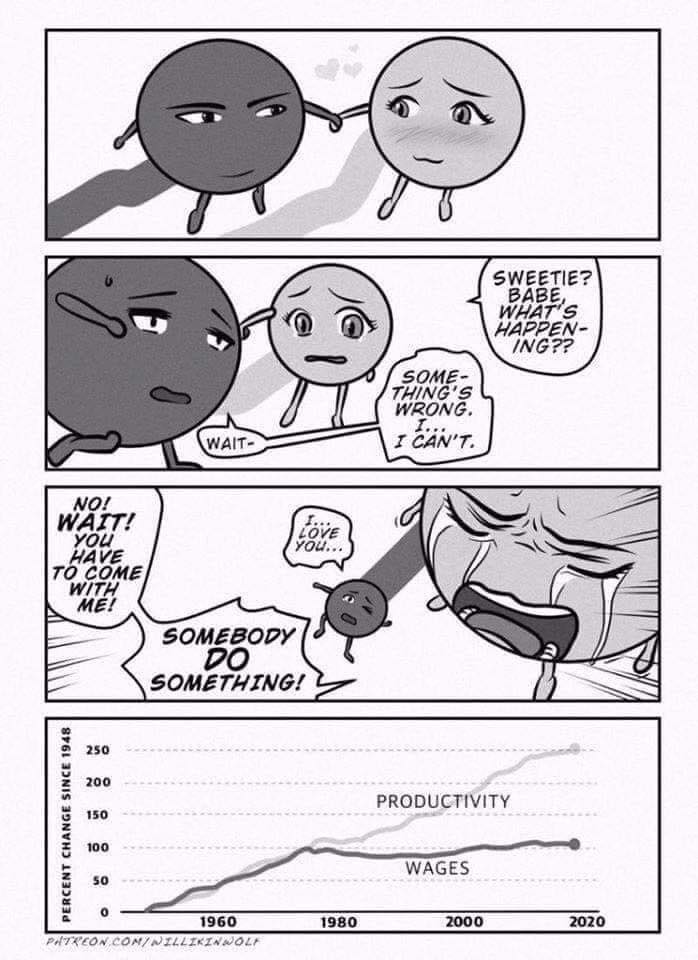

https://wtfhappenedin1971.com/

What's the answer?

Jack Welch.

some say computers/digitalization of work.

Possibly the final nail in the coffin of the gold/silver standards (Aug '71)? I'm not at all saying that we should have stayed on a commodity standard for currency, but switching that completely off without also having sufficient protections for financial shenanigans seems like it would create exactly the kind of increase in inequalities shown.

https://youtu.be/iRzr1QU6K1o

Probably end of the gold standard

is that the best explanation available? i think that the 1973 oil crisis (which completely changed the dynamics of the global economy) and Regonomics in the 80s are much more impactful. I know neither of those happened in 1971, but the site shows graphs in which 1971 and 1973 would be almost basically the same, and most show a much steep change in the 80s

No. Just libertarian nonsense, ending the gold standard ended the Great Depression. 1971 marked the total abandonment of it but it was over in practice in the 30's.

Edit: Not that I'm anything close to an expert, and despite that line I tend consider the idea that inflation is good to be class warfare, but that date is a correlation, not a cause.

What actually happened in the early 70's was the Vietnam War and the rise of neoliberalism, until it seized the reins of power with Carter and Reagan.

And, yes, Carter was the start of the decline. Reagan actually had quite a few policy overlaps with him, he just hated brown people, unions, and commies a lot more. Carter might have meant well, and he's certainly got less blood on his hands than most Presidents, but the path was set regardless.

I think there's probably a pretty good argument that that final abandonment of gold sealed the doom of economic neoliberalism and modern monetary policy, but the reality is the people who push that idea are generally trying to sell you crypto and silver.

End of the gold standard.

Before, if you didn't get a raise, the minimum wage would at least keep up with inflation since it was tied to gold

That's.....just not true at all. Commodity based currency is just as prone to inflation as fiat, the only thing it does is introduce volatility to your currency if the commodity market faults.

Gold does not have a definitional inherent worth, meaning if the government wants to "print" more money while on the gold standard, they just change the monetary value of gold, as Roosevelt did in 33'