this post was submitted on 27 Apr 2024

719 points (96.3% liked)

Political Memes

7779 readers

3172 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

No AI generated content.

Content posted must not be created by AI with the intent to mimic the style of existing images

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

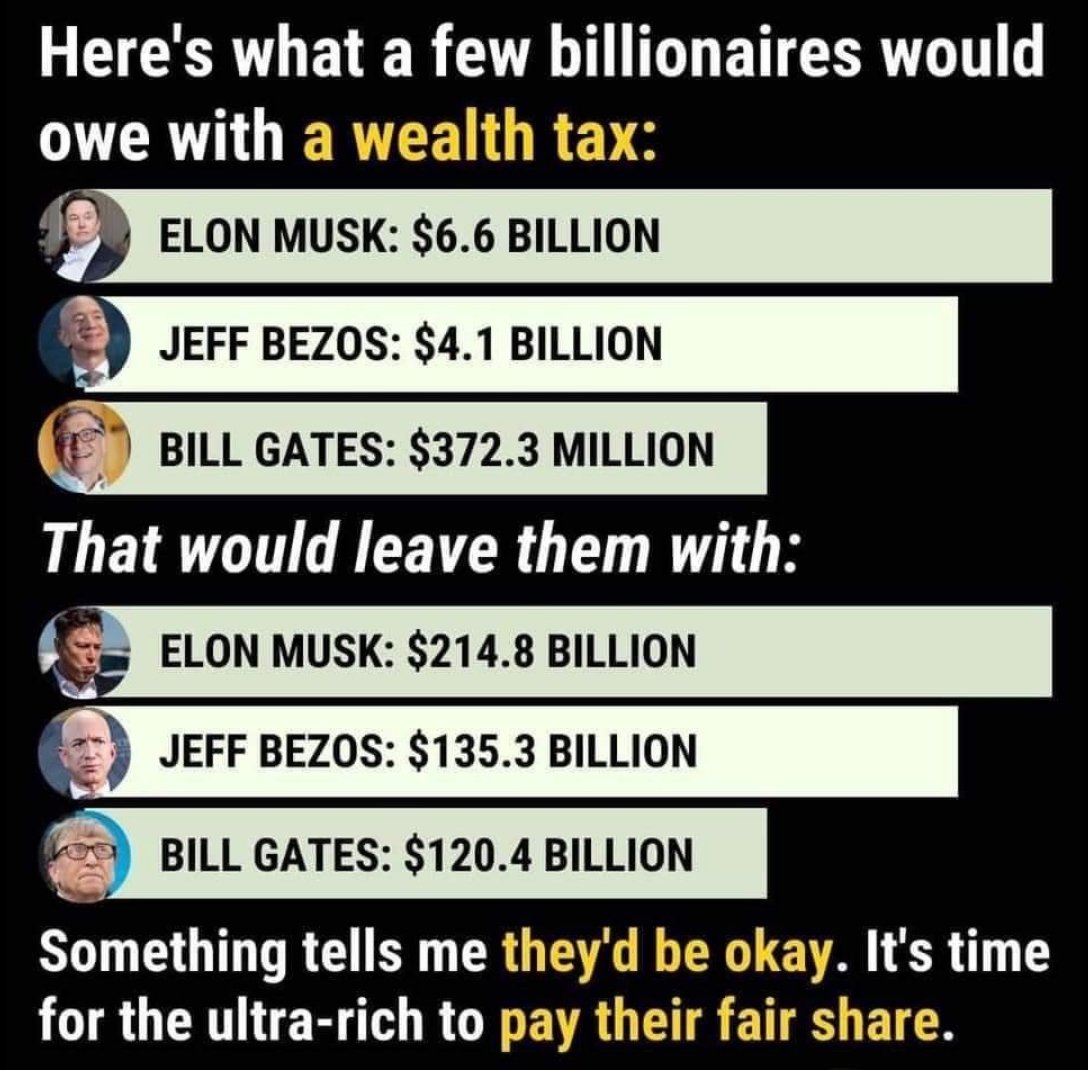

How is 4% "fair share" when I am paying 24%

I assume that you pay tax on your income, not your wealth/assets, so that is something different.

But these aholes take loans out on their wealth, thus effectively using this wealth as cash. Cash that is not taxed.

I don't question that their income from what ever source should be (highly) taxed. However the wealth tax should be on top to fix the errors made in the past (and are currently made) leading to such accumulation of assets. The question is how should non-liquid wealth, such as estates, shares and bonds, be taxed.

Yeah and then they pay interest on that loan, which is income to the lender for them to pay tax on; then when the original loan comes due the billionaire either refinances and pays even more interest, or pays back the loan by selling their appreciated assets and then - yes - pays tax on the income. So either way the tax is getting paid, now or later, and you have no idea how frustrating it is to see people parroting this over and over and over, and downvoting you for pointing it out.

Yes, but the rest of us still pay a WAY higher percentage of our wealth AND income in taxes than they do. It's a regressive system.

My post was in response to someone bitching about borrowing against property with unrealized gains to avoid tax, try and keep up.

Yes, but you also pay tax on everything else including housing and every day goods via Sales tax. And as a percentage of wealth I'm sure that adds up to way more than 4%

But my taxes as a percent of my wealth are probably closer to 20 percent (e.g. 20,000 in taxes on 100,000 in wealth), than the 2 percent suggested here.

4% every year, perhaps?

Anyway, this graph assumes something between 3.0 and 3.1%, and exactly 10 times less (decimal point error?) for Gates.

Maybe there's a difference between wealth and income, but nobody around here would care about such things.

You think they have paid the tax when they acquired the wealth, i.e. when it was income?

This is a super basic apples and oranges concept, please try and keep up.

Your original comment was bitching about 4% not being a fair share when you are paying 24%. Wealth tax is not the same as income tax.

I think everyone is subject to income tax in the US when the income is taxable to them, yes. Eventually all of these big bad mean rich people will pay tax on their unrealized gains one way or another. No need to create a wealth tax because eventually the income tax will kick in, I promise you. There's no need to fuck with the tax code even more, and by doing so totally breaking accounting and tax concepts in a way that only government can, just out of this populist notion that they aren't paying their fair share, whatever that means.

Wealth tax is not income tax but it is certainly still not a fair share when I'm paying 24% of all my income and they are paying 4% tax overall.

Are you a bot? Wealth tax is not the same as income tax. You can't compare 24% to 4%. It just doesn't work that way. I don't know how to be more clear.

Suppose you take one of your remaining dollars after paying 24% tax on your gross income. You buy a penny stock and it skyrockets to the moon and you are now worth 100 billion on paper, and you stay at your 100k/yr white collar desk job. Your only income is your 100k salary. You haven't actually earned any income yet or triggered any taxable events. Income happens when you sell, not when values fluctuate. Your fair share is 24,000 now and then capital gains tax whenever you sell your share of that stock. This wealth tax is absurd because it's literally just a timing difference between now and whenever you sell, or whenever you die, whichever happens first. That tax is going to get paid one way or another.

You guys are getting your panties all twisted up over a temporary timing difference. And the worst part is you just don't even know what you're talking about, or how chaotic it would be implementing such a thing, which would never work in practice, or even the fact that it's unconstitutional and would require an amendment to be legal. This whole thing is just idiotic.