this post was submitted on 29 Apr 2024

1122 points (98.4% liked)

Political Memes

5409 readers

3901 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

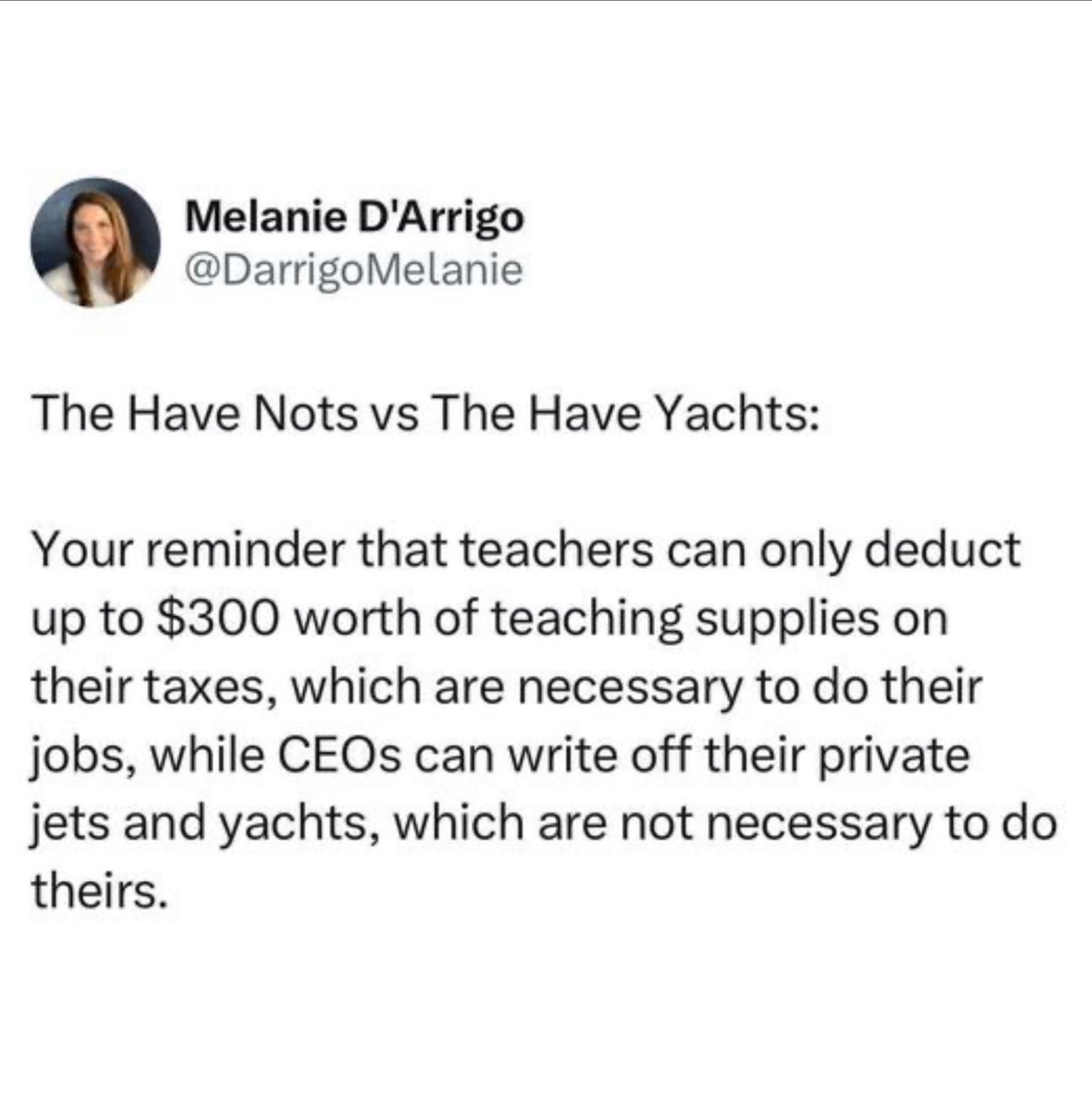

This is just plain incorrect.

The law doesn't allow CEOs to write off yachts.

Whether or not regulators investigate them is another matter.

That's why they don't own the yachts, but they own the charter companies that run the yachts.

Can't they just buy in the name of a company, which would be a 'business expense', which is kind of a write off?

They would have to justify how it is a part of the companies operations. In theory at least.

So a private jet to fly your execs to business meets? Ok.

A yacht? Maybe for entertaining customers? I don't know about the US, but here in Australia entertainment expenses are written off at a lower rate than other business expenses.

A yacht can have meeting rooms, you can receive clients in these meeting rooms for business purposes, making it therefore a business expense.

Sorry mate. Not really correct.

If an Australian company pays for entertainment expenses for staff, it's considered a fringe benefit and fringe benefits tax is payable. It equates to almost the cost of the actual expense. So if a company pays $10k for an employee to take a holiday, they'll have to pay almost $10k in fringe benefits tax, but they do get a deduction for the whole $20k, which will save them $5k in income tax.

Yeah, so to simplify, written off at a different rate.

Not really, at all.

It's written off at the same rate, while being subject to a whole other type of tax, which means the company pays more tax, rather than less.

Ok, so the point I was originally trying to make was that claiming a yacht as an entertainment expense was less attractive. Would you agree?

If sticking a fork in your eye is "less attractive" than eating icecream then sure.

... but let's be honest, that's not what you were trying to say. You were just plain wrong. Get over it. No one cares.

The only one who can't admit they were wrong here is you.

It doesn't work like that. Expenses need to be "necessarily incurred in the course of producing income". Just be cause a company pays for something doesn't make it tax deductible.

I can't have a yacht business meeting without a yacht now can I?