A left-leaning friend of mine who was big into economics and business (as it was, well, his business) once described our current financial system as having organically and piecemeal emerged bit by bit into a rat's nest of tangled protocols. And that now it's ended up as a Gordian knot strangling us to death, but that cutting will kill us.

memes

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

And that now it’s ended up as a Gordian knot strangling us to death, but that cutting will kill us.

so why wait?

Now you sound like him. But his was an advocacy based less on "Let's get it over with" and more "I've had a brick on the pedal for years and I've been waiting to find a good cliff to drive off of"

Now you know why econ forecasting as an industry has such a high rate of liver failure. No one can stay sober when both options result in a complete unwinding of society. There are no good ways forward. There's, likely, no way forward.

I don't believe the current system (by that, I just mean the institutions controlling currency) is what's killing us. The economic policies of different governments are the ones killing us.

I am a strong believer in leftist policies. However, I also believe that we don't have a better system than markets. The presence of markets requires the presence of Keynesian economics if we want to avoid boom-bust cycles.

That being said, do I think Keynesian economics will continue to exist decades in the future? No. One of the biggest flaws of this system is that monetary policies require a lot of time to have an effect on the economy. This huge ping difference understandably introduces many issues.

There are better ways to control the amount of money in circulation (like fluctuating transaction fees) whose effects can be a lot more immediate. However, they require all money to be electronic.

Immediate impact is not necessarily a good thing. A lot of our economy is built on predictability. Imagine going to use your credit card, and something costs more because the fee jumped yesterday, and might be less tomorrow. Banks would build in bigger fees to avoid the uncertainty. Because people want certainty.

Changes in transaction fees wouldn't be so drastic though. As you can make tens of thousands of corrections per year (compared to a couple in the current system), changes wouldn't affect you so much.

The whole history of compound interest is quite fascinating. Early arguments for it are that seeds and livestock are capable of reproducing and multiplying themselves. If I lend you a handful of seeds and a year later you give back the exact same size handful, I have lost a whole year’s production I could have gotten out of those seeds.

Furthermore, assuming you actually planted the seeds instead of tucking them away in a drawer somewhere before giving them back later, those seeds produced a crop for you. This crop you could harvest and sell or feed yourself or your family or livestock. You could even save seeds from the harvest and pay me back the handful while keeping even more seeds for yourself. So by lending you seeds interest-free I’m essentially giving you a gift of harvest potential as well even more seeds in the future, at my own expense. Thus is the time value of money.

From this initial seed of an idea grows a huge amount of the financial system.

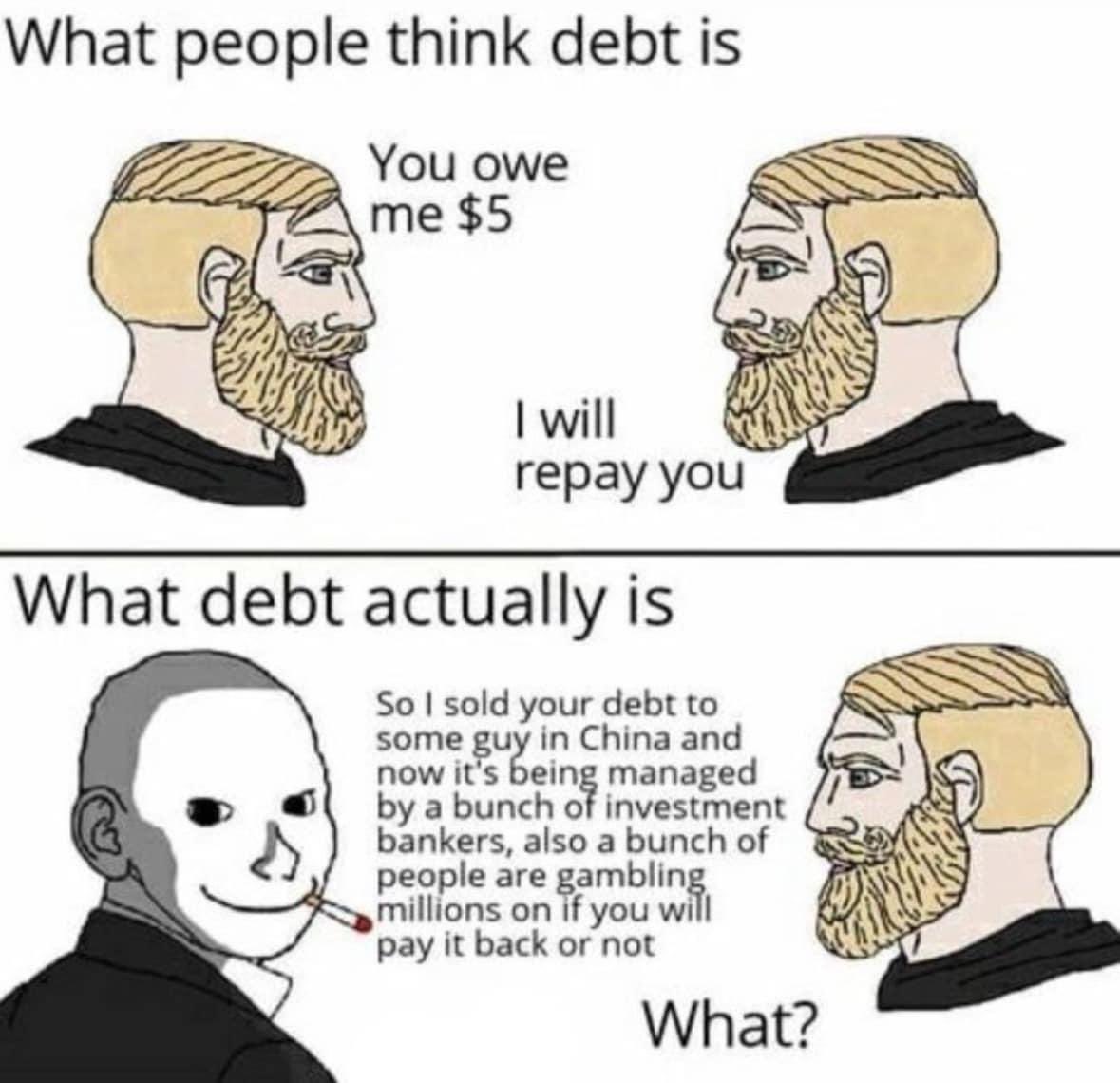

What it actually is:

We've given big, privately owned banks the right to create money out of thin air.

They lend it to you for a while, if you can prove that there's no risk involved.

You still have to pay them back a lot more than you got.

Once you've given the money back, it disappears.

The banks keep the interest, though. And can use it to create 10x more money out of thin air.

Man, if it were just this then banks would be pretty stable.

The problem is banks don't just lend and receive money, they invest. And they invest in everything. And they take super risky bets.

This is what caused the banking collapse of 2008 and what caused the death of SVB and a few other banks.

Your bank doesn't just hold your money and debt, if you rent it almost certainly owns a peice of the company managing your property. It owns crypto assets. It has shares of startups. And it uses those assets to get more money to create more debt.

Dobb Frank was created to stop some of this, but unfortunately it's been effectively repealed already.

Yup, and banks are returning to high-risk securities, trading in debt-based products like collateralized loan obligations, just like they did leading up to the 2008 global financial crisis.

Bank: You should take out this loan you can’t afford to repay. Don’t worry, we’ll make it seem like a great idea.

Unqualified borrower: Ok, since you made it seem like a great idea.

Bank: Great! Hey, other bank, betcha this guy won’t repay this loan.

And Dodd-Frank was passed as a weak facsimile of the previously-repealed Glass-Stegall act that was written after the Great Depression and effectively prevented any major financial collapses for 70 years.

1000%

We created this money to give to you, and you have to pay it back plus a 5-20% fee.

We're also betting on whether you will pay it back or not, and other people are betting on whether our bet will win.

If we lose too many bets, or too many people bet against our bets, then the money we just gave you disappears, the economy crashes, and you get kicked out of your house.

Fractional reserve banking and the modern securities market is a trip. Kafka was on to something.

It's not out of thin air, it's out of your account, and everyone else's too. They're banking (heh) on most people not needing most of their money all at once. They keep a required reserve amount for people to actually withdraw. If all of the sudden everyone wants all of their money then that's a run on the bank and it collapses.

No, it is actually out of thin air.

When a bank gives out a credit, that money is created on the spot, not drawn from somewhere.

There are rules as to how much money a bank is allowed to create, based on how much they actually have.

But no account of any kind is reduced by the amount they give out as credit.

no but y y youre youre youre youre y you're saying the money's in Joe's house, th thats that's right next to yours, and and and and the Kennedy House, and Mrs Maitlin's house and a hundred others.

w w why w why why why whaddaya want the Moon, Mary? L L L Lemme throw a LASSoo around it.

Yep. Just don't borrow it, fuck em.

Unless you're really rich, you have the choice between borrowing money from the bank, and paying rent to a landlord for your entire life.

Unless you're moderately rich, you don't even have that choice.

The derivatives market is out of control. The global annual GDP, actual goods and services produced, is something like $100 trillion. The derivatives market is something like 7 times that.

About 80% of the global economy is just gambling on what the other 20% will do.

A derivative != gambling what the other 20% will do.

A common derivative is a "future".

Pre-ordering a videogame is a future contract. It's a way for game publishers to finance the development of the game.

Sometimes futures are the only way to trade a product: all electricity is sold under a future contract. This refers to producers and consumers agreeing "tommorow 11am to 12am, I will consume (for the one party), and produce (for the producing party), 10MW of power". It is a simple necessity to trade electricity as a future contract, as electricity isn't easily stored, and the grid needs to be balanced (production ~= consumption) at all times. Here, the future contract is used as a method of coordination.

Futures are still technically gambling. In some cases a very, very safe gamble, but it still boils down to promising a predetermined price for a future transaction. There's always a chance that the underlying asset radically changes in value between the contract and execution dates.

I don't deny that derivatives are certainly financial instruments with valuable use cases. I'm just saying the scope of that market is out of control, especially in regards to financial derivatives. The MBS market basically directly lead to the '08 crisis, as you certainly know.

Futures are still technically gambling.

If you enter into a futures contract to fix your costs (electricity, oil, steel etc.) then you are reducing your risk. This is the opposite of gambling.

Sometimes doing nothing is the risky option.

Gambles on failure of stocks shouldn't be allowed, regulate wall street WS. They will make off like bandits when the tariffs hit.

The derivatives market is something like 7 times that.

The notional value is that size, but that's not really representative. You can't compare or even add notional amounts.

For example, temperature derivatives would have a notional value measured in millions of °C.

Well put

While funny, and this is a the meme community, God it's so much worse than that. Debt accumulated in a western style capitalist society is just how money exchanges hands. Your debt, the one that deeply affects your life, that can ruin your ability to make basic purchases and health care is a simple gamble for the rich, OUR debts.

Their debts are waved away, all because it makes more profits to forgive major mistakes when the other people are rich. I'm looking at you GM and Chrysler, I'll never forget.

Edit: I forgot.

Wasn't Ford the American auto company who didn't have to be bailed out by taxpayers while GM and Chysler did?

Maybe. Listen, what I said was in the moment. You can't blame me for being stupid on the internet lol.

Your debt, the one that deeply affects your life, that can ruin your ability to make basic purchases and health care is a simple gamble for the rich, OUR debts.

well no, so there are technically two types of debt, personal debt, the kind of shit you have on your car or house. Which are generally negative, and then investment based debt, a debt that is presumed on the potential future evaluation of a company for example. This is inline with how a lot of VC funding is done, although more complex.

There's also the concept of having asset backed debt, for example a car, or a house. The downside here is that cars and houses are generally very important to daily life, but if your debt is based on the valuation of your company for example, that inherently holds significantly less personal risk to you.

There's also a much more complex macro economic theory, where if extremely large players go down, a significant portion of the economy also goes down. It might be beneficial for a government to absolve the debt of a national company if for example, it protects broadly from a significant economic retraction, similar to the kinds we've seen before like in the great depression. Granted in that case, we did nothing, and everything imploded, globally.

Money is literally an "I owe you"

When money was first used, instead of exchanging an apple for an orange, X amount of apples is exchanged for a dollar. The dollar is the buyer saying "I owe you" to the seller.

When the apple seller now use the dollar on something else, that's just selling the "I owe you" in exchange for something else.

Spending money is just selling debt.

(At least that's how money has always worked in my mind. Listen, economy is weird, idk how this shit works, I'm just coming up with my own explanation okay.)

Historically, debt existed before money existed. But that only works in a framework where people can trust eachother to repay the debt.

Debt: The First 5000 Years by David Graeber is a cool book about this whole topic

It's not the buyer saying "I owe you", but the issuer of the currency (actually, usually just the notes, coins are considered to have value). The first person/entity to get the note gave, or promised, the issuer (usually the central bank) something of value, and the issuer gave them a token (note) saying the bank owes the holder of that note a certain amount of value. The recipient can then trade that note freely, as can future recipients, in the knowledge a vendor will accept it for its face value. So, yes, you're trading debt when you use money, but it's the bank's debt to the holder, not the debt of the buyer.

Typically the bank issue money when someone takes a loan, i.e. promises that they will pay the bank the value of the loan plus interest.

Bartering also assumes, for your example, that the apple farmer wants oranges and the orange farmer wants apples. Consider that either one may not. And then consider how many other goods exist even in primitive agrarian society that people may or may not want at any given time.

Currency is whatever the agreed vehicle is for value exchange that solves this. The apple farmer can now sell apples for silver nuggets and use the silver to buy tools from someone else later, which the orange farmer either doesn't have or is unwilling to part with. It allows for more complex transactions that then helped grow more complex societies.

I have a bunch of letters from my family dating back to the civil war. It's fascinating how many IOUs there are in there for like a bushel of apples, or a scrap of leather, or whatever they traded to their neighbors. Like you said, scraps of paper with IOU were literally used like currency, but the real currency was people's reputation to make good on their debts, the paper was just to track it.

doesn't pay it back

2008 financial crisis

when your puny change in mortgage loan causes upwards of a billion dollars worth of ~~investments~~ gambling to fall apart

My Student loans were sold before I even finished school.

Don't even ask the question.

The answer is yes, it's priced in.

Think Amazon will beat the next earnings? That's already been priced in.

You work at the drive thru for Mickey D's and found out that the burgers are made of human meat? Priced in. You think insiders don't already know that?

The market is an all powerful, all encompassing being that knows the very inner workings of your subconscious before you were even born.

Your very existence was priced in decades ago when the market was valuing Standard Oil's expected future earnings based on population growth that would lead to your birth, what age you would get a car, how many times you would drive your car every week, how many times you take the bus/train, etc.

Anything you can think of has already been priced in, even the things you aren't thinking of.

You have no original thoughts. Your consciousness is just an illusion, a product of the omniscent market. Free will is a myth.

The market sees all, knows all and will be there from the beginning of time until the end of the universe (the market has already priced in the heat death of the universe).

So please, before you make a post on Reddit asking whether AAPL has priced in earpods 11 sales or whatever, know that it has already been priced in and don't ask such a dumb fucking question again