The Albanese government released its employment white paper last week.

It presented the document as a major piece of work, comparable to white papers from past eras.

It outlined the government's ambition to fix major problems in our labour market, and it contained a new definition of "full employment."

But was it ground-breaking? Will it lead to cultural change?

The scourge of involuntary unemployment

Let's start with some positives.

The government says the concept of "full employment," as the Reserve Bank defines it these days, is inadequate.

It says what the RBA considers full employment has co-existed with a large amount of "involuntary unemployment" in the economy, and it wants to change that.

This is important.

The debate about involuntary unemployment stretches back more than 80 years and it's really interesting to see the government resurrecting it.

I'll show you what I mean.

In 1936, British economist John Maynard Keynes published an influential book called The General Theory of Employment, Interest and Money.

It inspired a wave of "full employment" policies that washed across the democratic world in the 1940s and 50s.

Keynes showed, in that book, that the traditional way of thinking about unemployment was ignorant and damaging.

He said orthodox economists assumed there were only two types of unemployment: frictional and voluntary unemployment.

But there was actually a third type — involuntary unemployment — that described the reality of millions of people who wanted to work but couldn't get work because there wasn't enough demand for their labour.

He said "full employment" would only exist when involuntary unemployment disappeared (leaving only frictional and voluntary unemployment).

And his book opened peoples' eyes.

It inspired policymakers in countries like Australia to deliberately stimulate economic activity to create enough demand for labour so involuntary unemployment would collapse as a category.

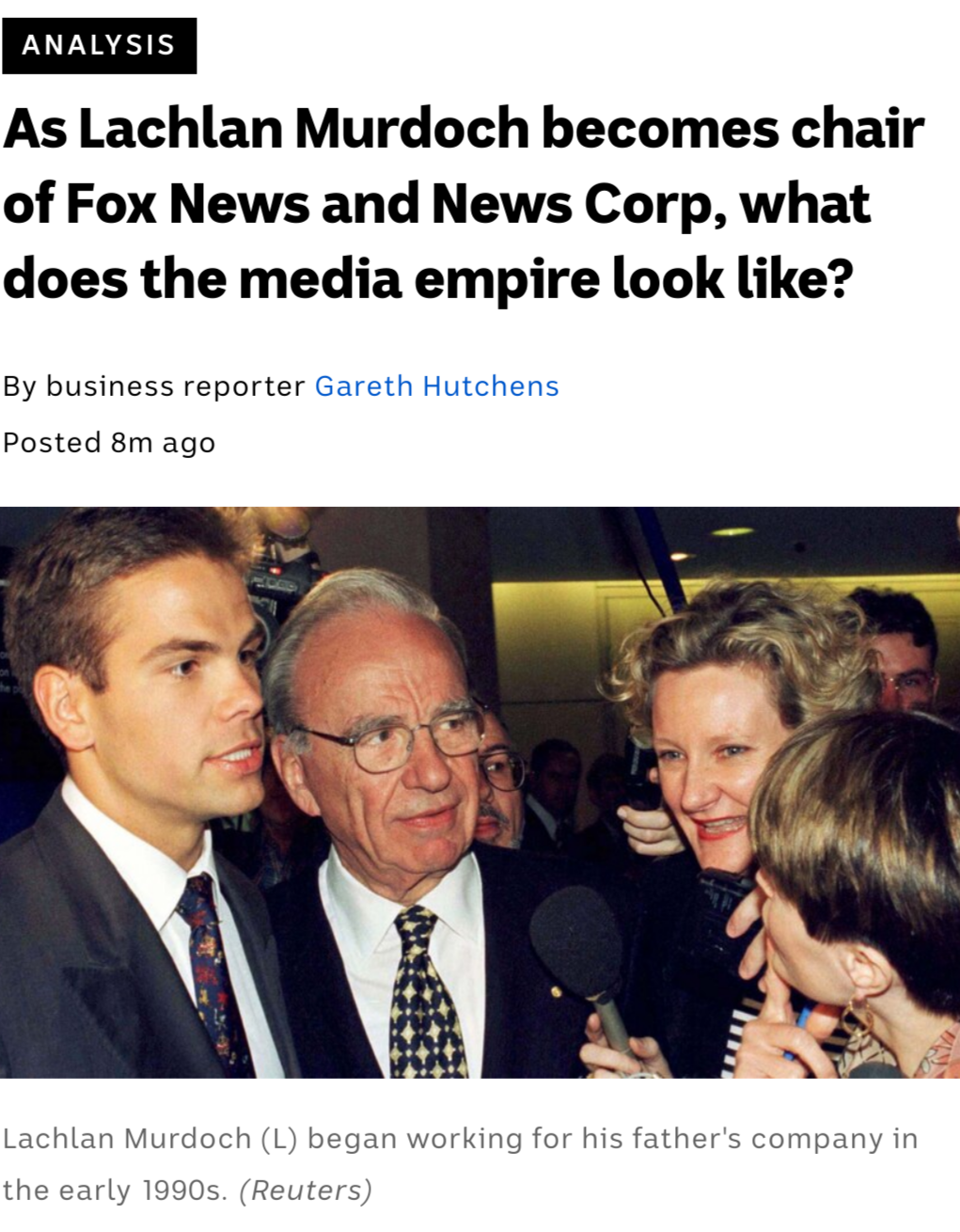

See the graph below.

It shows what happened to Australia's unemployment rate in that post-war era of full employment policy.

Full employment and unemployment average

Now, fast forward to today.

The government's Employment White Paper is clearly drawing on some of that thinking.

It says the modern definition of "full employment" used by the RBA is far too narrow, and our conversations about full employment have to admit the reality of involuntary unemployment and high levels of under-utilisation of Australian workers in the modern era.

It's also revived some wisdom from older conceptions of full employment by reminding us that genuine full employment has qualitative aspects too.

What does that mean?

It means the quality of a job is also important for people, and jobs should pay fair wages and be reasonably located. And if someone's unemployed, it should never take them so long to find a job that it starts to demoralise them.

Those qualitative aspects of full employment were emphasised by William Beveridge in 1944, in his landmark work "Full Employment in a Free Society", which I wrote about a few months ago.

According to Beveridge, if full employment meant anything it meant an abundance of jobs that paid decent wages, where unemployed people don't languish in unemployment, and where labour markets slightly favour workers, not employers.

So, the Albanese government is drawing our attention back to the scourge of involuntary unemployment, and it's emphasising the qualitative aspects of abundant work, to say that that's what full employment really is.

So that's all really interesting.

A bit of courage, but not too much

Strangely, after building the case for a "new" definition of full employment, the government's white paper feels like it melts away.

It doesn't promise to use a muscular set of policies to drive involuntary unemployment out of the system quickly.

Instead, it uses a lot of words (the paper has 264 pages) to explain something meek, which is: it doesn't actually want to be too disruptive.

So, the paper says the Reserve Bank will continue to use its too-narrow concept of full employment to make decisions about monetary policy, but the government will try very hard to remove supply-side barriers to employment to help structural unemployment decline over time.

That way, it says, if things go according to plan, the RBA should eventually be able to sustain a much lower level of unemployment than it has for decades, with much lower rates of labour under-utilisation.

Does that sound revolutionary to you?

It doesn't to me. It sounds like the same ambition successive governments have had for 30 years, ever since the Reserve Bank began targeting inflation in the early 1990s.

And in a moment of cognitive dissonance, the white paper even criticises the outcomes of that familiar policy approach.

"Despite its many successes, the Australian economy has rarely achieved full employment for extended periods and there have been prolonged periods when the available labour force was under-utilised to a much greater extent than it is today," it says.

So, it's hard to avoid the feeling that this white paper is slightly confused, or is saying a lot about not very much.

But then, maybe that's unfair.

Maybe it does have a big ambition but it's obscured by verbiage. Or maybe it's deliberately obtuse, and we'll have to wait to see what type of legislation the government tries to pass through parliament before we understand what its ultimate agenda is.

Would it survive a change of government?

So where does it leave us?

Would it be easier to be enthusiastic about the white paper if its vision was clearer and its ambition bolder?

On that score, it does compare unfavourably to the 1945 White Paper on Full Employment.

That 1945 paper was much smaller (it only contained 131 paragraphs), was written in the simplest language, and it had a major impact.

It declared its intentions from the start: it wanted to change Australia.

When John Dedman, the minister for Post-War Reconstruction, presented the paper to parliament on 30 May 1945, he didn't mince his words:

"I believe that this white paper constitutes a charter for a new social order.

"The old order of the inter-war years had as its prime objective rigid adherence to a certain financial policy. If this entailed 30 per cent unemployment and dwindling world trade, then, according to the pundits of that day, these were necessary evils.

"What a miserable social structure they built on their own false foundation."

He explained clearly how the white paper was structured:

"First, it sets forth boldly and unequivocally the government's intention to secure full employment for the people of Australia after the war.

"Secondly, it outlines the method by which the government proposes to achieve this aim.

"Thirdly, it examines the special problems which will face the Australian economy in the transition from war to peace."

And he said Commonwealth and State governments had to accept responsibility for stimulating spending on goods and services to the extent necessary to sustain full employment, because the welfare of everyone depended on it:

"The policy of full employment is the government's positive contribution to the security of the individual. Full employment spells opportunity, and opportunity opens the way for achievement [...]

"This white paper is an affirmation by the government of Australia that it intends to pursue that policy with the utmost energy and determination."

Clear and digestible. There was no guessing what the policy was or what the government planned for the country.

And when the government lost power four years later (for a variety of reasons), that full employment policy was popular enough to survive the change.

In fact, the victorious Liberal Prime Minister, Robert Menzies, adopted it as his own and pursued full employment for the next 16 years.

Can we see that happening with this white paper?

smiling is banned